T+1 Securities Settlement Update March 2022

Background

In 2017, Canada, the U.S., and other countries reduced the standard time it takes for debt, equity, derivatives, and investment fund transactions to settle, from three days after a trade (T+3) to trade date plus two days (T+2).

Recent market volatility has increased systemic and trading risks as well as collateral requirements. This has created an incentive for the industry to reduce risk by decreasing the time for settlement even further.

Industry Implementation Schedule

On December 1, 2021, the Canadian industry and U.S. counterparts decided to move to T+1 to clear and settle a security, to be implemented in the first half of 2024. Now the U.S. is thinking to move this target date up to Q1 2024.

Historically, Canadian capital market stakeholders have realized that it is more cost-effective for Canada to remain in sync with U.S. settlement practice.

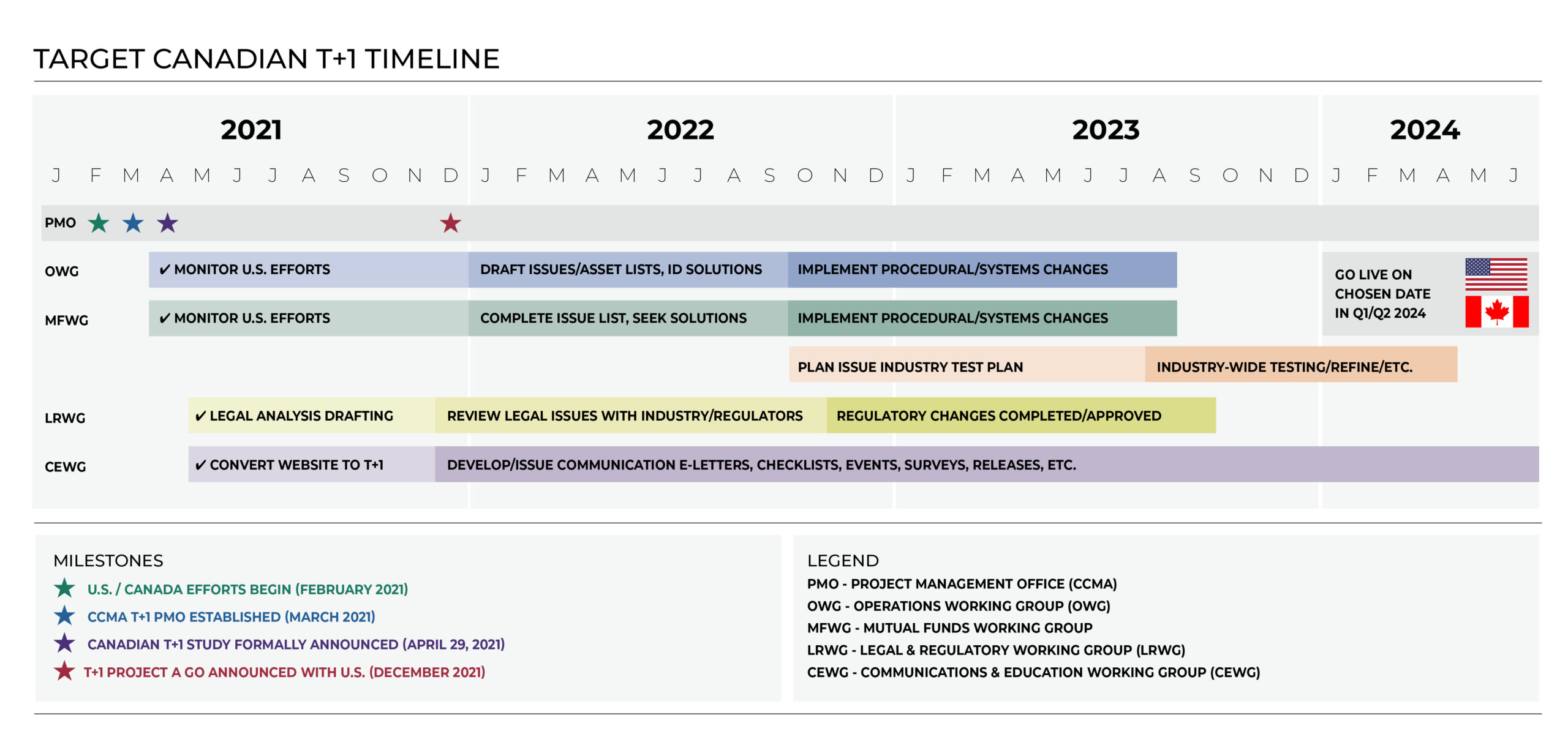

The following Canadian Capital Markets Association (CCMA) high-level T+1 timeline is linked to the U.S. implementation schedule.

Challenges:

- Instruments involved: The current assumption is that it would be the same list that moved to T+2 including, Stocks, Bonds, Mutual Funds, Segregated Funds, REITs, ETFs, etc. The detailed list of T+1 instruments is currently under review.

- Process changes: Developing new timelines for security processes such as: Stock Exchange Feeds, Trade Entry, Block Allocations, Trade Confirmations, Trade Corrections, Securities Lending, Collateral Processing, Corporate Actions, Global Settlement, Foreign Exchange, New Issues and more.

- Legal implications: Updating National Instrument 24-101 and resolving any other legal and regulatory issues.

- Issues management: Creating comprehensive Industry T+1 issue logs and potential solutions.

What Should You Be Doing Now?

The US T+1 Steering Committee recommends that firms begin immediately to work with their counterparties, custodians, vendors, regulators, and clients to better understand the internal impacts related to timing deadlines, system improvements, and process changes required.

What are your people, process, data and technology changes that need to be addressed?

Not Sure How It Impacts Your Firm?

Contact us at info@jclm.bm or give us a call to set up a consultation

Jennings Consulting Limited is a collaborative effort bringing together highly experienced consultants and business leaders who believe and excel in creating value for the clients: providing strategic insights and solving complex business challenges to increase their revenue, capture operation efficiency, deliver expense reduction and create sustainable businesses.

Our clients are the leading financial services companies in Canada, Bermuda, Bahamas and Barbados – many of whom we have worked with multiple times and supported for as many as 20 years.

.